Introduction

During tax season, filers may need to use various forms, each with its specific purpose. A person's employment may require them to submit multiple forms to provide a complete and accurate picture of their income. If you're an independent contractor, you should familiarise yourself with Forms 1040 and 1099. We'll go through what a 1040 and 1099 are, how they differ, and where they overlap. Here you’ll learn about 1040 vs. 1099: tax forms explained.

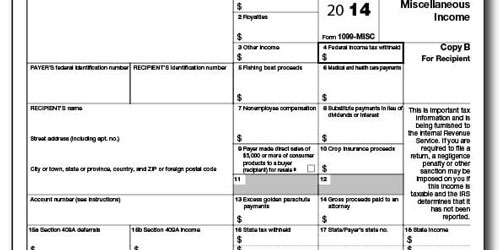

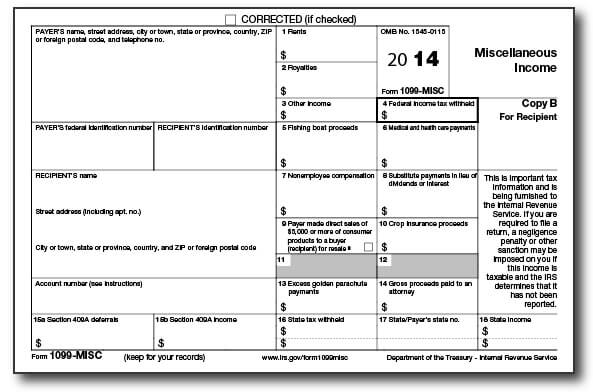

What Is a 1099 Form?

Information reports, or 1099 forms, are filed with the Internal Revenue Service to report money earned by an individual other than from a salary or wages. Form 1099 provides details about a person's income that are not included in Form W-2. The several varieties of Form 1099 each detail a certain kind of income.

What Is the Purpose of Form 1099?

For the Internal Revenue Service (IRS) to collect the correct amount of taxes from U.S. citizens and residents, Form 1099 is required. 1099 is considered an "information return" by the IRS. The Internal Revenue Service (IRS) compares its data with the information reported on 1099 forms, the income reported on taxpayers' Form 1040 (the tax form used to report personal federal income tax returns), and the information reported on other forms, such as the W-2 forms (submitted by employers to report all salaries paid to employees) to determine whether or not any discrepancies exist.

Form 1040 – What Is It

Form 1040 is more of a template than a specific tax return. All of a person's earnings and deductions are listed here. A person's taxable income and any outstanding tax obligations are detailed. If the taxpayer overpaid their taxes, their refund amount could be shown on their Form 1040. Additional paperwork may be required depending on the individual's taxable income (which we refer to as Schedules).

1040 vs 1099: What the Numbers Mean

The implied relationship between the 1040 and 1099 forms and taxes is the one that is the most direct.

1040, which is for personal income, is the tax form that is utilised by professionals the most. Every worker, whether they are considered employees or independent contractors, must submit a Form 1040 tax return yearly.

Any customer who paid you $600 or more as a self-employed person during the tax year is obligated by law to give you a Form 1099-Misc. Even if the revenue you made from your self-employment was less than $600 and you were not issued a 1099-Misc form, you are required by law to report any income you made.

099 vs 1040

Here are some ways that a 1099 form and a 1040 form can differ:

Types

The amount of kinds available for each form is one of the most glaring distinctions between a 1040 and 1099. There is just one type of 1040 form, and that's because it displays data from all the various tax forms a taxpayer may need to file. This implies that workers from all walks of life submit a standard 1040 form, while the specifics of the data they provide may vary. However, multiple 1099 forms exist for persons to use when reporting nontraditional income.

Primary Usage

The most common uses of the 1099 and the 1040 forms can vary, as each is designed to accomplish a somewhat different set of goals. The principal use of the 1040 form is to reveal a taxpayer's total income to calculate their tax liability or refund. The 1040 form accomplishes this by compiling all of the necessary tax information in one place, which is especially helpful for filers with different income streams. In contrast, 1099 is often used to report a single source of income and its associated amount. Information from a 1099 form can be found on a 1040 form, but only about the specific type of income for which the form was issued, such as self-employment, capital gains, or royalties.

Conclusion

Non-employee income is reported on Forms 1099 to the payee and the Internal Revenue Service. Whether or not you owe taxes depends on several factors, including the amount of income reported on Form 1099 and other financial information you provide on Form 1040. Taxpayers must file a 1040 form with income over the filing threshold. 1099 will be issued exclusively to persons who have earned money in ways other than as an employee. Interest, dividends, Social Security, and self-employment are just a few of the many income sources requiring their own unique 1099 form.